Keeping track of your money and where it needs to go may feel like a difficult task. That’s why visually mapping it can be especially helpful. When I work with clients, I help them create a visual flow chart to show where every dollar goes. Today, I want to walk through why I do this, and how you can get started on your own money map.

Simplify Decision-Making

The goal of money mapping is creating a clear visual guide of what to do with every incoming dollar. If you’re confused about where to put incoming money, your systems can quickly get out of whack. By drawing out the paths your money can take, you make it clear to yourself where everything needs to go. You also simplify the decisions you need to make, because you have everything spelled out right in front of you! This way you’re able to take action to put your money in the right place quickly and easily.

For extra points, you can automate some of these transfers each month, so that you don’t have to move everything manually. If that sounds interesting, you might like to read “Pick One of These 5 Tips to Automate Your Wealth”.

How Much Do You Need?

In order to create that map and streamline your decision making, you need to do the math up front. It’s important to think about how much you need for your own pay, business taxes, and operating expenses. When I work with clients, I help them determine these numbers in the process of creating their map. If you want a DIY version, you can check out my articles on financial self-care, which will help you determine your personal expenses and understand how they relate to your business finances. Going through your records and averaging your operating expenses can help you get a good idea of what that percentage might be.

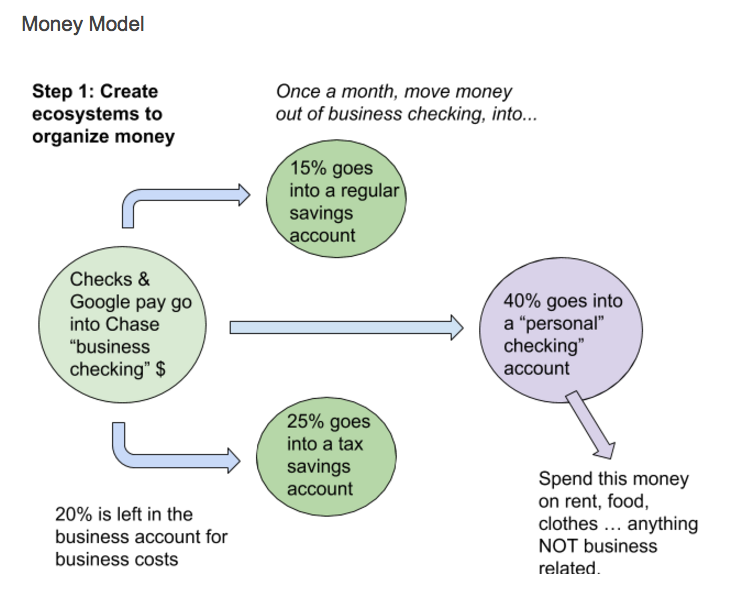

The above image is an example map from Hadassah Damien at Ride Free Fearless Money. In this example, you can see that she’s fleshed out the necessary percentages of income that need to be set aside for savings, taxes, business expenses, and personal expenses. In part 2 of our discussion of money mapping, I’ll talk about Profit First and what these percentages are according to their theory.

From Income to Final Destination

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

Above all, the goal of money mapping is to know where your money is going every step of the way. From the moment you receive income, to the moment that money is saved for taxes, invested for retirement, or put away for a savings goal – you’ve got a plan. Consequently, this is an opportunity to define those final destinations. Creating a tax savings account and an operating expenses account come in handy here. You can also think about creating savings goals for yourself, and making a plan to contribute regularly to those.

If you found this article interesting and helpful, I invite you to download the first 5 chapters of Profit First! The book has its own suggested money map that I’ll also talk about in part 2 of this series. If you’re into this kind of thing, I’m sure you’ll enjoy the book.

Angela

[…] In-Depth Guide to Money Mapping and How it Can Fortify Your Business, Part I, Part II, and Part […]