At Peace With Money’s Best of the Blog 2021

This year at At Peace With Money, we covered a lot of great topics on the blog, so I thought it might be a great time to do a “best of” post to wrap up the year. Collected below are our top 10 blog articles from the past year. The topics run the gamut from money affirmations to taxes, but all of these articles provide solid enough insights that they became crowd pleasers! My goal is always to provide helpful and compassionate financial education resources, and I think these ten posts do a great job of just that.

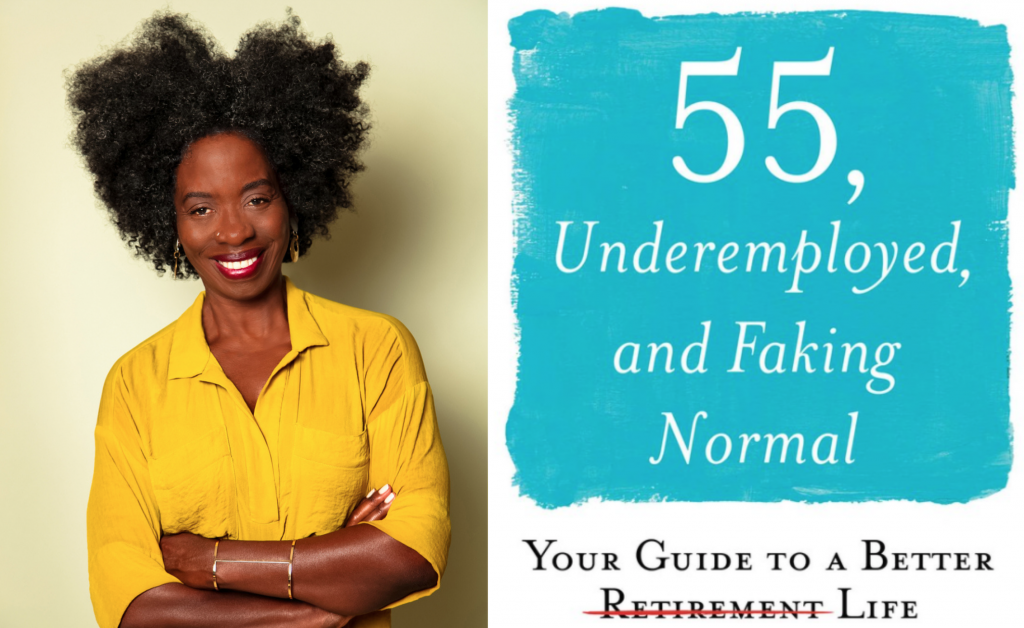

- Book Review: 55, Underemployed, and Faking Normal – In which I highly recommend Elizabeth White’s wonderful book, which manages to combine healthy doses of compassion and practical advice, a potent and helpful mix.

- How to Use Affirmations to Transform Your Relationship With Money – This post goes into depth on my thoughts on how money affirmations can assist us in rewiring our money mindsets and digging through the emotional baggage we carry around our finances.

- Why You Should Always Base Your Financial Goals on Your Values – A post that goes into the ideas central to my financial coaching practice, this article discusses the link between values and life satisfaction, and the importance of avoiding lifestyle creep.

- Why Self-Compassion is Important During Tax Time – I believe financial self-compassion is always important, but especially at tax time, it can help us keep a cool head and clarify solutions!

- Why You Need a Year End Bookkeeping Review – A couple practical reasons to get your books reviewed – a great read if you’re new to DIY bookkeeping.

- Why Financial Education is One of the Best Investments – Three strong reasons to invest time and resources into financial education, this is another good read for people just diving into financial learning.

- How to Prep for the Holidays as a Service-Based Business – Service-based businesses can get overlooked during the holidays, but that doesn’t have to be the case!

- Boost Your Happiness By Clarifying Your Lifestyle Costs – Your business exists to support you; to fulfill your needs. If you don’t have a clear picture of what those needs are, it can be difficult for your business to fill them.

- Boost Your Social Impact With the Power of Belief – This post on reclaiming your power in your community as a small business owner is all about believing in your vision for a better world!

- How to Tailor Your Income Goals to Your Life – If you’re on board with investigating your values and making sure your money reflects them, but you need a method for how to get there, start here!

I hope you enjoy this list of top 10 blog posts! While you’re at it, this might be a great opportunity to reflect on your own financial year. What were your big financial lessons of 2021?

Angela

we want to work with can be immensely helpful. I encourage you to spend some time thinking about your why and your current offerings, and how they’re related. Is your why reflected in what you offer? Do you feel fulfilled by offering those products or services?

we want to work with can be immensely helpful. I encourage you to spend some time thinking about your why and your current offerings, and how they’re related. Is your why reflected in what you offer? Do you feel fulfilled by offering those products or services?

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

“The cavalry is not coming.” The author is adamant that one important facet of managing financial insecurity and instability is accepting your circumstances. She discusses the importance of letting go of magical thinking, and introduces the concept of “smalling up.” This concept encourages us to think about what we really need to be content, and prioritize that. Going beyond a call for us to live within our means, she asks us to think about what it would mean to “live a life not defined by things.”

In this article, the term “financial education” refers to any resource that helps you better understand your finances. Whether this is a podcast, a YouTube channel, a workshop or class series, or working with a coach or bookkeeper, anything you find helpful in this arena counts!

In this article, the term “financial education” refers to any resource that helps you better understand your finances. Whether this is a podcast, a YouTube channel, a workshop or class series, or working with a coach or bookkeeper, anything you find helpful in this arena counts!

Above all else, when faced with a decision around your business, refer back to your

Above all else, when faced with a decision around your business, refer back to your

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”

The Butterfly Effect dictates that small events have a rippling effect that can cause much larger events to occur. While you may feel that your contribution to the world is small, what you do ripples out. I love this quote from author and activist Grace Lee Boggs, who says, “We never know how our small activities will affect others through the invisible fabric of our connectedness. In this exquisitely connected world, it’s never a question of ‘critical mass.’ It is always about critical connections.”

What opportunities might financial self-compassion open for us during tax time? For starters, instead of blaming and punishing ourselves for our financial missteps by going it alone this tax time, financial self-compassion might inspire us to open up to a money buddy about our tax concerns. We might get some useful ideas or feedback this way. We might also take a look at our spending plan, and decide that the money needed to

What opportunities might financial self-compassion open for us during tax time? For starters, instead of blaming and punishing ourselves for our financial missteps by going it alone this tax time, financial self-compassion might inspire us to open up to a money buddy about our tax concerns. We might get some useful ideas or feedback this way. We might also take a look at our spending plan, and decide that the money needed to  With peace and self-compassion,

With peace and self-compassion,

Claiming our power is an act of self love. When we honor and value ourselves and have the bravery and financial security to live our desires – that is real self love. This love ripples outwards, and makes a positive difference in the lives of those around us. By striving for what we really deserve, we can inspire and pave the way for a new generation of people ready to do the same. When we have the resources to donate to causes we agree with, we can heal the planet and help others achieve their dreams. When we claim our power, we can also extend that power to others.

Claiming our power is an act of self love. When we honor and value ourselves and have the bravery and financial security to live our desires – that is real self love. This love ripples outwards, and makes a positive difference in the lives of those around us. By striving for what we really deserve, we can inspire and pave the way for a new generation of people ready to do the same. When we have the resources to donate to causes we agree with, we can heal the planet and help others achieve their dreams. When we claim our power, we can also extend that power to others.