7 Financial Tips for Business Owners During COVID-19

Following the recent restrictions on gatherings, businesses that are allowed to be open, and all other health concerns and restrictions, your business may be caught in the wake of COVID-19. You are not alone. There are many business owners in similar positions to yours. While I don’t have a silver bullet for ending this pandemic (unfortunately) I do have a couple ideas of how you and your business can move through this turbulent time.

Be Proactive With Creditors and Landlords

For many people, rent and mortgage payments are due on the first of April, coming up in ten days. You may also have other bills, such as credit cards or debt payments coming up soon. If you are at all concerned about your ability to make these payments, I encourage you to get in touch with your creditors and/or landlords. Politely but firmly explain your situation to them and ask if you can work something out, like a reduced payment or a refined payment schedule. Because so many people are in a similar place, you may garner their sympathy and receive some assistance.

Cull Your Expenses

Now is the time to really go through your personal and business expenses with a fine-tooth comb. Cancel any subscriptions or memberships that aren’t vital. If you’re in California or Illinois, for example, then you’re probably not going to the gym or yoga studio anytime soon. Review your business’s spending needs and nix anything unnecessary or now irrelevant.

Get Creative With Your Services

Think about ways you can adapt your business to the current times. Maybe it’s time to ramp up your online store and start doing local delivery. Many yoga teachers and entertainers are starting to offer their services online. Brainstorm and get creative.

Check Available Resources

Every community has different resources available to those struggling with expenses due to COVID-19. Here in California, you can refer to the information provided by the Employment Development Department to see if you qualify for aid. Also check local nonprofits and other resources. Many communities are creating volunteer networks and community funds to protect the most vulnerable in the community. If you are seriously at risk, consider seeking these out. Otherwise, consider contributing to them, either monetarily or with volunteer time.

Lean On Your Money Team

This is a time when those on your money team can really come in handy. Reach out to your financial confidants, your bookkeeper, financial coach, etc. and start strategizing on how you can fortify your business during these tough times. Don’t make these decisions alone; remember that you have allies.

Mindset Matters

Although the virus is seriously threatening, those most at risk are the elderly and the immunocompromised. It’s important to remember that we are taking all of these measures in the name of collective care, to protect those of us who are most vulnerable. I encourage you to remember this and to avoid self-victimizing, panicking, or hoarding. Holding onto a mindset of courage and generosity will do wonders in this time, for your own mental health and everyone around you.

File Your Taxes On-Time!

File Your Taxes On-Time!

You may have heard that the IRS has officially extended the deadline to pay taxes to July 15, 2020. While this is great news for business owners, it’s important to remember that you still need to file your taxes by April 15th. If you are unable to meet this deadline, you can request a six-month extension for filing. You can check out the IRS site for more info. EDIT: The deadline to file has also been extended!

I hope these ideas bring you some sense of hope and agency in unpredictable times.

Angela

What Do You Gain From This?

What Do You Gain From This?

In short, there’s a feedback loop between your finances and your identity as a business owner. Therefore, the best thing to do is to really look at your business’s finances. If you feel underpaid,

In short, there’s a feedback loop between your finances and your identity as a business owner. Therefore, the best thing to do is to really look at your business’s finances. If you feel underpaid,

or for expansion. You can read more about the

or for expansion. You can read more about the

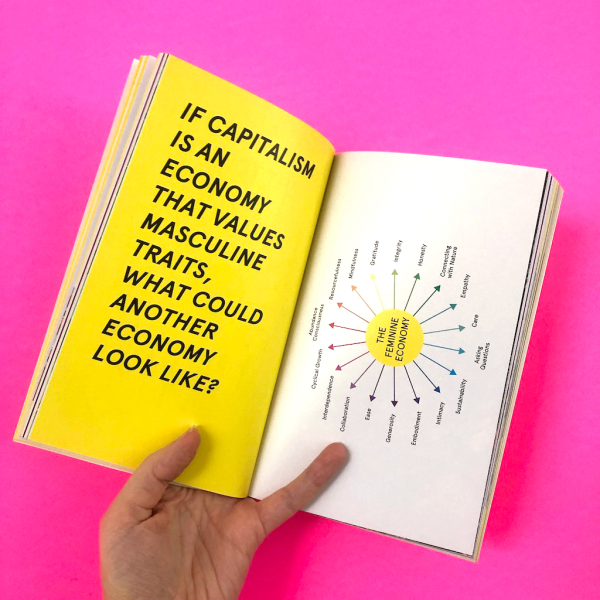

Lastly, I very much enjoy her thoughts about cultivating an abundance consciousness. Again, it is easy to define abundance through numbers when thinking about businesses, and particularly for me as a profitability coach. She reminds us to “feel how rich you are already” and to remember that “money isn’t the only form of wealth”. These are the lessons I try to remember when I define the success of my business and the success I am helping my clients to experience. I highly recommend checking out

Lastly, I very much enjoy her thoughts about cultivating an abundance consciousness. Again, it is easy to define abundance through numbers when thinking about businesses, and particularly for me as a profitability coach. She reminds us to “feel how rich you are already” and to remember that “money isn’t the only form of wealth”. These are the lessons I try to remember when I define the success of my business and the success I am helping my clients to experience. I highly recommend checking out

If a resource ticks all these boxes for you, it will probably set you down the path to financial wellbeing! And it will feel a lot better than trying to read something that just isn’t for you. Next time, we’ll talk about starting the search for resources. For now, feel free to do some good ol’ googling. You can also check out my article on

If a resource ticks all these boxes for you, it will probably set you down the path to financial wellbeing! And it will feel a lot better than trying to read something that just isn’t for you. Next time, we’ll talk about starting the search for resources. For now, feel free to do some good ol’ googling. You can also check out my article on

Now it’s time to find some good resources that meet your criteria. Some googling might help with this, but you can also check out my post on

Now it’s time to find some good resources that meet your criteria. Some googling might help with this, but you can also check out my post on

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

afternoon off, a fun or inspiring event, or whatever you’d like to do to celebrate your achievements so far! Being a self-starting solopreneur is hard work. If you’ve done the work, you deserve to cheer yourself on once in a while.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.

When you’re making your plan, be sure to adapt your goals to what’s worked so far this year. If you really love a certain routine or feel fired up to keep working toward a certain goal, go for it. If you’ve stalled on a project because you need to do more research, carve out some time to go back to the drawing board. When charting your course, keep your own needs and preferences in mind.